Finance & Banking

Finance – Banking has achieved many successes through 20 years of innovation, attractive profitability. However, the difficulties and challenges of fierce and unstable competition are still urgent issues that need to be addressed.

1. The worry of the banking sector

- Bad debt situation of commercial banks

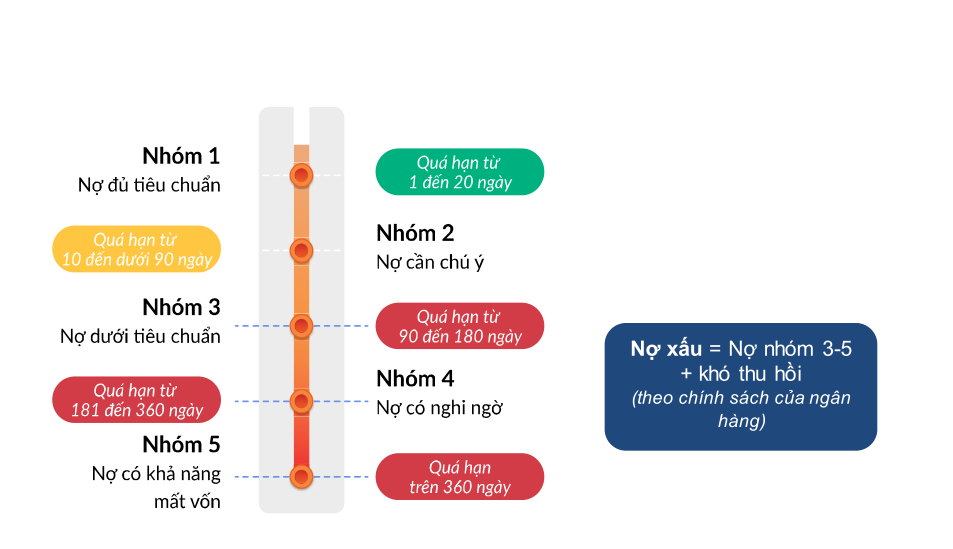

Bad debt is the money that the bank lends to the customer, but when the debt collection is due, it cannot be reclaimed due to subjective factors from the customers such as businesses, credit institutions that make losses, Bankruptcy leads to the insolvency of the bank’s borrowed debt when it is due.

Bad debt has been, is and may continue to have a negative impact on the flow of capital into the economy. The higher the ratio of bad debts, the greater the risk and the loss of capital flows of commercial banks. This is considered to be the main cause of constraining and limiting the flow of credit flows in the economy.

When talking about bad debt, in addition to the control ability of credit institutions, it is also necessary to consider the situation of the economy and borrowers in many aspects on an objective, subjective and relevant basis. many different parties.

According to the business report published by 22 banks in the first 9 months of 2018, the total bad debt increased by 26.5% compared to the end of last year to VND75,826 billion (not including the bad debt balance at VAMC). Meanwhile, customer loan growth was modest at only half of 11.3%.

Most surveyed banks have increased their bad debt balance, while banks increased by more than 80%. Banks with strong increase in NPLs include NCB (80%); OCB (65.2%); VPBank (51.6%); MBBank (45.1%); LienVietPostBank (41.9%); VietBank (40.4%), …

In fact, if the bad debt situation is still not improved, the bad debt will still be a big burden for credit institutions and the whole economy.

For customers: NPLs will increase operating costs, increase debt burdens for banks, reduce capital flow rate with banks that directly affect the relationship of both parties, thereby prestige. Creditworthiness of customers will be reduced significantly, making commercial banks no longer dare to lend to customers, even though the capital is not lacking. Banks have to be more cautious with loans to avoid further bad debts, resulting in banks having money that cannot be lent, while the economy continues to thirst for capital.

- Pressure to increase capital

According to experts, raising capital is an urgent issue for banks to meet Basel II standards. Preliminary statistics show that only Vietcombank, VIB and OCB have been awarded by the SBV to implement Basel II capital safety standards.

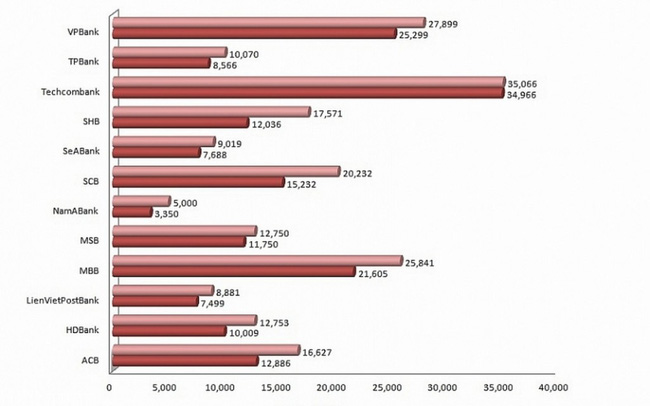

The chart compares the capital increase of commercial banks in 2018 and 2019

While many banks are ultimately building their foundations, the basis for implementing these two important circulars. Because if the capital cannot be raised, then banks cannot dare to boost credit growth and in the current context of Vietnam, if the credit does not increase, it is difficult to achieve high profits.

Although calculated according to current regulations, the capital adequacy ratio of the whole banking system is still over 12%. However, if applied according to Circular No. 41/2016 / TT-NHNN, this coefficient will be significantly reduced, possibly below 8%.

In addition to these existing challenges, according to banking experts, credit institutions also face other difficulties and potential risks such as market risks and operational risks. Since then, it will increase difficulties and challenges for banks in finding profits or investments for the purpose of increasing capital as prescribed.

- Lack of stability in human resources.

Human resources of the banking and finance industry is really a headache problem for managers. Excess is not redundant, without missing and without. There is a surplus in quantity, but a lack of quality. Each recruitment period of the bank (especially for cases of recruiting business development positions) can reach thousands of employees. Although businesses can still recruit the same number of employees, still able to meet the appropriate regime for each object, but when starting to work from 1 to 3 months, the proportion of new employees is on leave. up to 42%. A cycle of personnel instability continues and continues without the optimal solution

Selling ineffective credit products.

Improve the efficiency of selling credit products with solutions to improve sales skills, customer care from professional, intensive and regular training courses for the staff from the first time working. . Enterprises can invest in a specialized department of training necessary skills for human resources. Or mobilize personnel to attend training courses on sales knowledge and skills outside the enterprise.

2. Solutions to overcome difficulties

Tightening the quality of input personnel

Ensure employee stability by applying a more rigorous recruitment process and selection criteria. Willingness to eliminate unqualified candidates to have a truly qualified “seed” team, this is the basis for the business system to operate stably, smoothly and develop.

Most of the sales of financial products are done via voice channels by calling customers directly for marketing and sales. Outgoing calls are only made manually by telephone in the usual way, which leads to wasting time, manual manipulation from the operator, reduced performance & business efficiency, lack of management capabilities. & customer information security. Investing in a Contact Center helps to effectively overcome traditional weaknesses.

Solve difficulties that businesses are facing with integrated Contact Center solution at CEM CENTER T5R: